The Digital Rails Behind Google Pay and PhonePe: Decoding the UPI Revolution

Unified Payments Interface (UPI) is the digital backbone powering India’s real-time payments, enabling 24x7 instant transactions across B2C and C2C markets. With over 18 billion monthly transactions (as of 2025), it has revolutionised how Indians pay—seamless, user-friendly, secure, and instant.

This blog unpacks UPI’s architecture and functioning for anyone looking to understand:

What is UPI and why is it transformative?

Who are the major players in the ecosystem?

How does a UPI transaction actually work?

How do banks and fintechs earn revenue?

What happens during settlement?

Bonus: What's powering the backend infrastructure?

1️⃣ What is UPI and Why Is It a Big Deal?

UPI (Unified Payments Interface) is a real-time payment system developed by the National Payments Corporation of India (NPCI). It enables seamless inter-bank transfers via mobile apps using IMPS (Immediate Payment Service).

At its core, UPI functions as an intelligent and efficient payment routing network, underpinned by a scalable, high-availability infrastructure.

📌 Similar to Faster Payments Service (FPS) by Pay.UK in the UK, UPI marked India’s digital leap post the 2008 global financial crisis (GFC). In response to this wave, NPCI was founded (as a non-profit) to unify and modernize India’s payment landscape.

🚀 What Makes UPI Transformational?

Instant, 24x7 payments using mobile phones

No need for IFSC or account numbers. Provides both Push and Pull (Collect) types payments.

Uses a unique Virtual Payment Address (VPA) for each user

Interoperability between apps (PhonePe, GPay, Paytm) and 500+ banks

Scalable & secure architecture powered by IMPS

Two-factor authentication (2FA) and encryption for security

In 2024, UPI clocked around 10 billion transactions monthly. By mid-2025, this number soared past 18 billion — reflecting its explosive adoption across India’s digital economy.

📌 VPA Explained: The Virtual Identity Behind Every UPI Transaction

A Virtual Payment Address (VPA) is a unique identifier, much like an email ID, that links your bank account to UPI. This eliminates the need to share account number or other sensitive banking details to make payments.

📎 Anatomy of a VPA:

Format:

username@handleusername– e.g.,bob-1(chosen by the user)handle– e.g.,okicici (Gpay),okhdfcbank (GPay),yapl(Amazon Pay) - defined by the PSP

💡 Example:

If Bob uses Google Pay (TPAP) and links his SBI or ICICI Bank account, his VPA might be bob-1@okicici.

✅ Key Highlights:

One user can have multiple VPAs within one app (within Google Pay) or across different apps (for routing efficiency and latency reduction). Think of it like multiple routes to destination, if one is congested, it can route you through different one defined by that VPA and corresponding PSP.

Handles vary by PSP and app partnerships. For instance:

Google Pay:

@okaxis,@okicici,@okhdfcPhonePe:

@ybl,@yesbankCRED:

@axisb,@yescred

2️⃣ Who Are the Major Players in the UPI Ecosystem?

UPI transactions involve 3 key roles:

🧩 1. TPAP (Third-Party Application Providers)

Apps that offer UPI interfaces to users:

📱 Examples: Google Pay, PhonePe, Amazon Pay, CRED, Flipkart UPI etc.

🏦 2. PSP (Payment Service Providers)

Licensed banks that connect TPAPs and customer accounts to NPCI:

🏛️ Examples: ICICI, HDFC, Axis Bank, Yes Bank, SBI

A TPAP must partner with a PSP to offer UPI services.

PSPs handle customer and merchant transactions, escrow accounts (for large merchants), and settlement.

🏛️ 3. NPCI (National Payments Corporation of India)

The central switch that:

Authenticates and routes UPI transactions

Ensures security, standardization, and scalability

Finalizes interbank settlements

📊 Market Landscape (ET, July 2025):

In the Merchant transactions - almost 60% of the transactions are made to the 4 big private sector lenders - Yes Bank, ICICI Bank, HDFC Bank and Axis Bank. Yes bank has the highest share of such transactions at 40% due to its large customer base via PhonePe.

SBI leads on customer-side UPI volumes with 25% of market share.

Google Pay and PhonePe dominate the front end, while Yes, ICICI, HDFC, Axis power the backend.

3️⃣ How Does a UPI Payment Work?

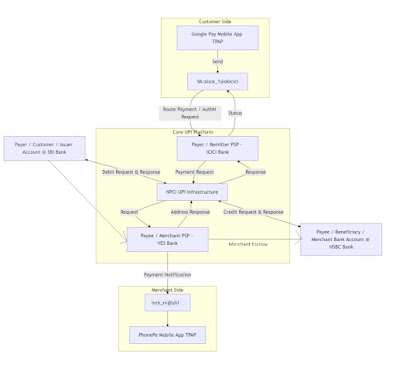

Let’s walk through a Customer-to-Merchant (C2M) payment:

📲 Flow Example:

Alice uses Google Pay (TPAP) to send ₹500 to a merchant using PhonePe (TPAP) backed by YES Bank (PSP).

🔁 Transaction Flow:

Alice initiates payment using Google Pay (VPA:

alice_1@okicici)Request goes to her PSP: ICICI Bank

ICICI routes the request to NPCI

NPCI authenticates & forwards to merchant’s PSP: YES Bank

YES Bank verifies the merchant account (e.g.,

merchant@yesbank)Funds move from Alice’s SBI account (she can have an account with any other bank let's say HSBC Bank) to merchant’s HSBC account

Merchant receives confirmation via PhonePe

🖼️ Visual Reference:

Below is the UPI transaction flow diagram, showing the entire end-to-end routing through TPAP, PSP, and NPCI

4️⃣ How Do Banks and Fintechs Make Money?

UPI is free for end users, but revenue is generated in several indirect ways:

💰 Banks (PSPs):

Merchant Fees: Small transaction-based fees (especially for large merchants)

Escrow Services: For platforms like Flipkart, Amazon

Value-Adds: Fraud detection, reconciliation reports, analytics

📈 Fintechs (TPAPs):

Merchant Onboarding & QR Services

Cross-Selling: Insurance, mutual funds, loans

Transaction Data & Promotions: Offering insights and advertising placements

Major PSPs like HDFC, ICICI, Axis, and Yes Bank have built new revenue streams from merchant-side UPI processing.

5️⃣ UPI Settlement Process

UPI settlements happen in near real-time. Here’s how it works:

⚙️ Settlement Types:

P2P Payments: Typically instant (within seconds)

Merchant Payments: Instant and sometimes T+1 settlement (for large value transactions/ escrow services).

Failed Transactions: Auto-reversed within seconds (usually <10s)

🧾 NPCI Settlement Flow:

Transactions routed through NPCI UPI Switch

Interbank settlement done via RBI-accredited banks

PSPs get credit/debit confirmation in real-time

Final balances settled via clearing batches

🔐 Security and Trust

UPI incorporates multiple layers of security:

Two-Factor Authentication (2FA) using UPI PIN

End-to-end encryption and secure hashing

Real-time fraud monitoring by NPCI and PSPs

According to NDTV (2025), 99.9% of failed UPI payments are reversed within 10 seconds — contributing to its mass adoption.

🧱 Bonus: Curious About Infrastructure Behind UPI?

The sheer reliability and volume of UPI demands robust digital infrastructure.

NPCI’s UPI Platform operates on high-availability principles, with:

Redundant data centers

Load balancing & failover

Scalable microservices & messaging queues

📖 For further reading on high-availability infrastructure design in cloud environments, check out my earlier blog post:

🔗 High Availability in Microsoft Azure

While it focuses on Azure, the concepts of redundancy, auto-scaling, and fault tolerance are directly relevant to platforms like NPCI’s UPI.

🔚 Conclusion

UPI isn’t just a payment method—it’s a digital public good that has redefined financial access and inclusion. Built on open infrastructure, secure standards, and public-private collaboration, UPI sets a global benchmark in innovation.

As the ecosystem evolves, expect:

Credit on UPI

International remittances

Voice-activated payments

AI-driven fraud prevention

From banks dominating the backend to fintechs leading the user experience — UPI is India’s fintech story in motion.

✅ Glossary

UPI: Unified Payments Interface

VPA: Virtual Payment Address

TPAP: Third-Party Application Provider (e.g., PhonePe)

PSP: Payment Service Provider Bank (e.g., ICICI, Axis)

NPCI: National Payments Corporation of India

Comments

Post a Comment